Can we shut up about having nothing to spend now?

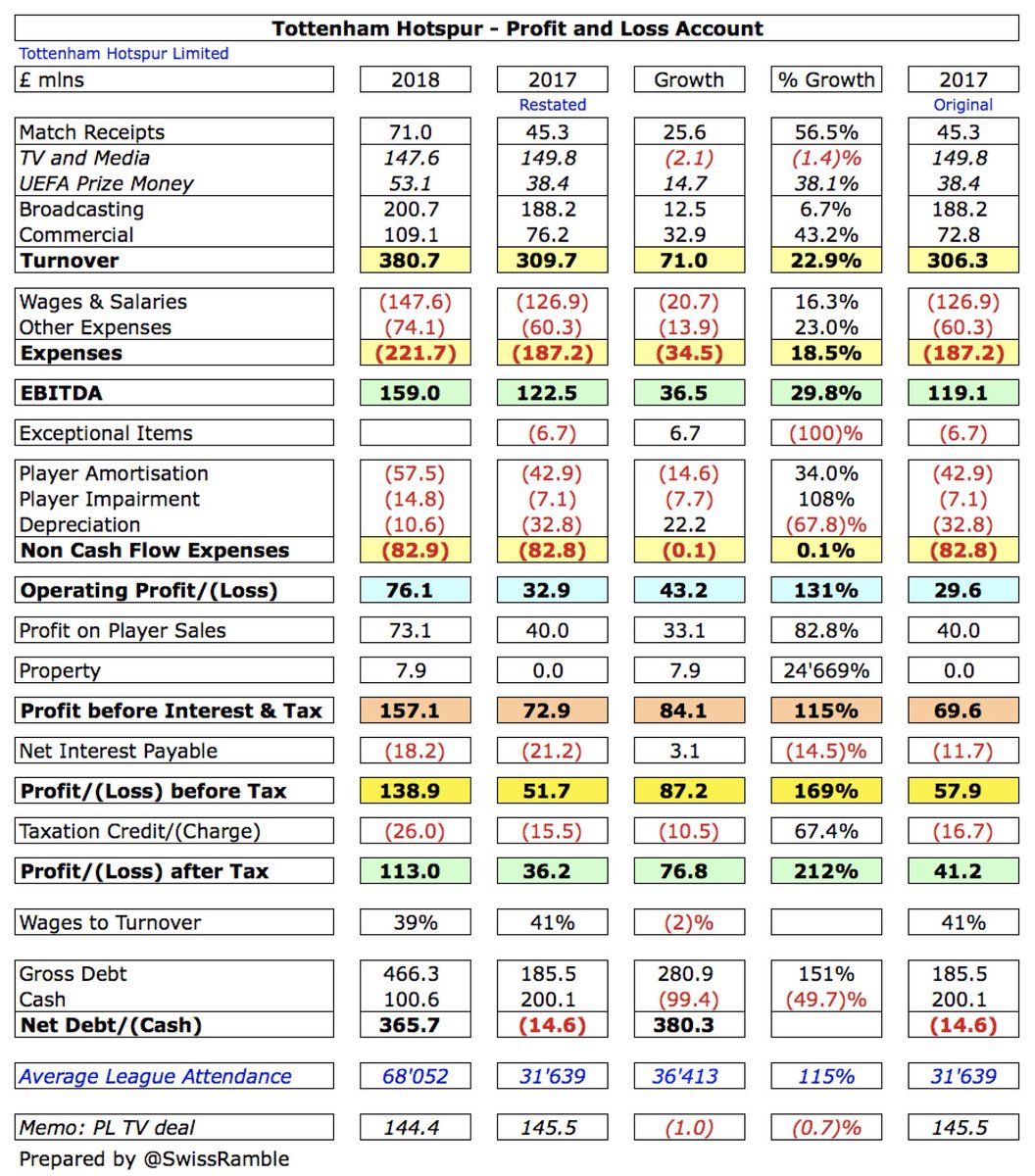

I've been telling that to anyone who'd listen. Perhaps now they'll understand. I also got the t/o almost spot on, profit was harder to predict.

Key facts to note are (as said above) it doesn't reflect the effect of the new deals., or the additonal 1.5 mill per game event fees for wembley, so profits might even look slightly subdued next year.

Debt may leap from around 380 to 675 mill.

Next summer should now prove my final point of argument here that the new stadium project overuns will not affect the player budgets - but don't expect us to go spend mad either, my expectation is 2/3 new additions that will be fighting for first team starts and 2, possibly three investments for next season and beyond. Of course, much depends on player sales and how they're stuctured.

IF we do somehow manage to be in the champions league next season, my prediction of full year finances for 2019/20 (reporting in 2021) remains at £521 mill (463 mill if no champions league).

As I've constantly argued, we will be a different proposition as a club and be able to compete with all but Europe's top 4/5 elite within 3-4 years.

All it requires now, is the right structured finance; possibly a share placing and the ability to spend when we have to, plus of course a manager who can craft all this positivity into a winning mentality.

And if all that makes Levy a billionaire; good luck to him.